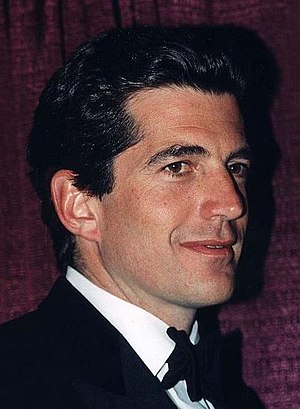

Andrew Fastow height - How tall is Andrew Fastow?

Andrew Fastow (Andrew Stuart Fastow) was born on 22 December, 1961 in Washington, D.C., is a Chief financial officer of Enron Corporation. At 59 years old, Andrew Fastow height not available right now. We will update Andrew Fastow's height soon as possible.

-

6' 0"

-

6' 0"

-

6' 2"

-

6' 2"

-

6' 4"

Now We discover Andrew Fastow's Biography, Age, Physical Stats, Dating/Affairs, Family and career updates. Learn How rich is He in this year and how He spends money? Also learn how He earned most of net worth at the age of 61 years old?

| Popular As |

Andrew Stuart Fastow |

| Occupation |

N/A |

| Andrew Fastow Age |

61 years old |

| Zodiac Sign |

Sagittarius |

| Born |

22 December 1961 |

| Birthday |

22 December |

| Birthplace |

Washington, D.C. |

| Nationality |

D.C. |

We recommend you to check the complete list of Famous People born on 22 December.

He is a member of famous Officer with the age 61 years old group.

Andrew Fastow Weight & Measurements

| Physical Status |

| Weight |

Not Available |

| Body Measurements |

Not Available |

| Eye Color |

Not Available |

| Hair Color |

Not Available |

Who Is Andrew Fastow's Wife?

His wife is Lea Fastow (m. 1984)

| Family |

| Parents |

Not Available |

| Wife |

Lea Fastow (m. 1984) |

| Sibling |

Not Available |

| Children |

Jeffrey Fastow, Matthew Fastow |

Andrew Fastow Net Worth

He net worth has been growing significantly in 2021-22. So, how much is Andrew Fastow worth at the age of 61 years old? Andrew Fastow’s income source is mostly from being a successful Officer. He is from D.C.. We have estimated

Andrew Fastow's net worth

, money, salary, income, and assets.

| Net Worth in 2022 |

$1 Million - $5 Million |

| Salary in 2022 |

Under Review |

| Net Worth in 2021 |

Pending |

| Salary in 2021 |

Under Review |

| House |

Not Available |

| Cars |

Not Available |

| Source of Income |

Officer |

Andrew Fastow Social Network

Timeline

In April 2016, March 2017, March 2018, and March 2019 Fastow spoke at the Ivey Business School. The University of Tampa's Center for Ethics hosted Fastow in October of 2017.

In February 2015, he spoke at: the University of St. Thomas, the University of Minnesota, the University of Texas (Austin campus), the University of Houston Bauer College of Business, the University of Southern California's Leventhal School of Accounting, and the University of Missouri School of Accounting.

In April 2014, Fastow spoke at Miami University in Oxford, Ohio, regarding business ethics.

After a former Enron executive leaked a copy of the offering memorandum for one of Fastow's partnerships, LJM–named for Fastow's wife and two sons–to the Journal, reporters bombarded Enron with further questions about the partnerships. The scrutiny died down after the September 11 attacks, but ramped up anew two weeks later with pointed questions about how much Fastow had earned from LJM. This culminated in a series of stories that appeared in the Journal in mid-October detailing the "vexing conflict-of-interest questions" about the partnerships, as well as the huge windfall he had reaped from them.

On October 23, during a conference call with two directors delegated by the board, Fastow revealed that he had made a total of $45 million from his work with LJM–a staggering total, since he claimed to spend no more than three hours a week on LJM work. On October 24, several banks told Enron that they would not issue loans to the company as long as Fastow remained CFO. The combined weight of these revelations led the board to accept Lay's recommendation to remove Fastow as CFO on October 25, replacing him with industrial markets chief and former treasurer Jeff McMahon. He was officially placed on leave of absence, though the board subsequently determined that it had grounds to fire him for cause.

In June 2013, Fastow addressed more than 2,000 anti-fraud professionals at the Association of Certified Fraud Examiners' 24th Annual ACFE Global Fraud Conference.

In March 2012, Fastow spoke on ethics to students at the University of Colorado Boulder Leeds School of Business.

Prosecutors were so impressed with his performance that they ultimately lobbied for an even shorter sentence for Fastow. He was finally sentenced to six years at Oakdale Federal Correctional Complex in Oakdale, Louisiana. On May 18, 2011, Fastow was released to a Houston halfway house for the remainder of his sentence.

Soon after his release on December 16, 2011, he began working as a document review clerk for a law firm in Houston.

After entering into a plea agreement with a maximum penalty of 10 years in prison and the forfeiture of $23.8 million in assets, on September 26, 2006, Fastow was sentenced to six years in prison, followed by two years of probation. U.S. District Judge Ken Hoyt believed Fastow deserved leniency for his cooperation with the prosecution in several civil and criminal trials involving former Enron employees. Hoyt recommended that Fastow's sentence be served at the low-security Federal Correctional Institution in Bastrop, Texas. Fastow was incarcerated at the Federal Prison Camp near Pollock, Louisiana.

In 2005, Kurt Eichenwald's Conspiracy of Fools features Fastow as the book's antagonist.

On May 6, 2004, his wife, Lea Fastow, a former Enron assistant treasurer, pleaded guilty to a tax charge and was sentenced to one year in a federal prison in Houston, and an additional year of supervised release. She was released to a halfway house on July 8, 2005.

In 2003, Fastow was a prominent figure in 24 Days: How Two Wall Street Journal Reporters Uncovered the Lies that Destroyed Faith in Corporate America by the reporters who had broken some of the key stories in the saga, Rebecca Smith and John R. Emshwiller. They painted Fastow as in their words "a screamer, who negotiated by intimidation and tirade".

Also in 2003, Bethany McLean and Peter Elkind wrote the book The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron ISBN 1-59184-008-2. In 2005, the book was made into a documentary film Enron: The Smartest Guys in the Room.

On October 31, 2002, Fastow was indicted by a federal grand jury in Houston, Texas, on 78 counts, including fraud, money laundering, and conspiracy. On January 14, 2004, he pleaded guilty to two counts of wire and securities fraud, and agreed to serve a ten-year prison sentence. He also agreed to become an informant and cooperate with federal authorities in the prosecutions of other former Enron executives in order to receive a reduced sentence.

In August, Skilling, who had been promoted to CEO of the entire company in February 2001, abruptly resigned after only six months, citing personal reasons. When reporters for The Wall Street Journal discovered an Enron "senior officer" had recently sold his interest in several partnerships that had done business with Enron, they initially thought that officer was Skilling. However, Enron spokesman Mark Palmer revealed that the "senior officer" was really Fastow.

Due to his work at Continental, Fastow was hired in 1990 by Jeffrey Skilling at the Enron Finance Corp. Fastow was named the chief financial officer at Enron in 1998.

Deregulation in the US energy markets in the late 1990s provided Enron with trade opportunities, including buying energy from cheap producers and selling it at markets with floating prices. Andrew Fastow was familiar with the market and knowledgeable in how to play it in Enron's favor. This quickly drew the attention of then chief executive officer of Enron Finance Corp Jeffrey Skilling. Skilling, together with Enron founder Kenneth Lay, was constantly concerned with various ways in which he could keep company stock price up, in spite of the true financial condition of the company.

While at Continental, Fastow worked on the newly emerging "asset-backed securities". The practice spread across the industry "because it provides an obvious advantage for a bank", noted the Chicago Tribune. "It moves assets off the bank's balance sheet while creating revenue." In 1984, Continental became the largest U.S. bank to fail in American history until the seizure of Washington Mutual in 2008.

Fastow graduated from Tufts University in 1983 with a B.A. in Economics and Chinese. While there, he met his future wife, Lea Weingarten, daughter of Miriam Hadar Weingarten (a former Miss Israel 1958), whom he married in 1984. Fastow and Weingarten both earned MBAs at Northwestern University and worked for Continental Illinois bank in Chicago. Both he and his wife attended Congregation Or Ami, a conservative synagogue in Houston where he taught Hebrew School.

Andrew Stuart "Andy" Fastow (born December 22, 1961) is a convicted felon and former financier who was the chief financial officer of Enron Corporation, an energy trading company based in Houston, Texas, until he was fired shortly before the company declared bankruptcy. Fastow was one of the key figures behind the complex web of off-balance-sheet special purpose entities (limited partnerships which Enron controlled) used to conceal Enron's massive losses in their quarterly balance sheets. By unlawfully maintaining personal stakes in these ostensibly independent ghost-entities, he was able to defraud Enron out of tens of millions of dollars. The U.S. Securities and Exchange Commission opened an investigation into his and the company's conduct in 2001. Fastow was sentenced to a six-year prison sentence and ultimately served five years for convictions related to these acts. His wife, Lea Weingarten, also worked at Enron, where she was an assistant treasurer; she pleaded guilty to conspiracy to commit wire fraud, money laundering conspiracy and filing fraudulent income tax returns, and served jail time before early release to a halfway house.